Mortgages for self-employed borrowers. What does that mean? If you are a self-employed borrower, is it more difficult to get a mortgage? Let’s first look at the definition of self-employed. Mortgage lenders and tax preparers look at that term differently. Maybe you work … [Read more...] about Are you Considered Self-Employed? A Mortgage Lenders Viewpoint.

Does Conflicting Credit Score Information Give you a Headache?

Some people think I’m too much of a fanatic about keeping credit scores high, (or getting them up there), but I know what a huge difference a great credit score can make in your day-to-day existence. If you buy or lease a vehicle, the total interest you pay varies by many … [Read more...] about Does Conflicting Credit Score Information Give you a Headache?

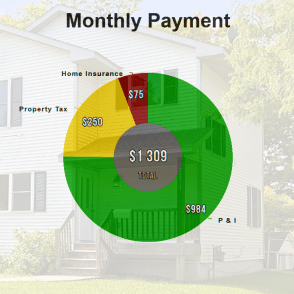

Tax and Insurance Impounds – Good Idea or No?

The question of tax and insurance impounds is one I usually get, even from experienced buyers. There are mixed thoughts on the matter. Your payment is made up of 4 components. Principal, Interest, Taxes, and Insurance. If you are required to also have Mortgage Insurance (as … [Read more...] about Tax and Insurance Impounds – Good Idea or No?