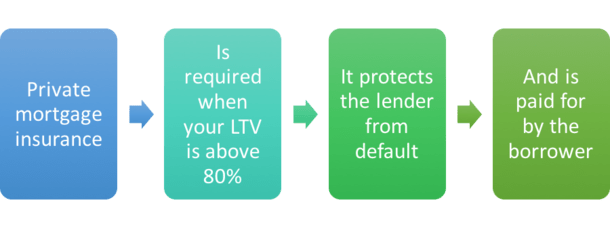

If you are required to have Private Mortgage Insurance, you need to understand what it is, why it’s necessary and when it’s required.

Mortgage Insurance lowers the risk (to the lender) of making the loan. Basically, it’s an insurance policy for the lender but you, the borrower, pay the premiums.

Private Mortgage Insurance = Mortgage Insurance (names used interchangeably)

Conventional Loans

A conventional loan is one which is not guaranteed or insured by any government agency such as FHA (Federal Housing Administration) or VA (Veterans Administration). A conventional Mortgage adheres to the guidelines set by Fannie Mae and Freddie Mac.

Private Mortgage Insurance requirements:

You will need Mortgage Insurance if your down payment is less than 20%. You’ll pay your Mortgage Insurance premium to the lender monthly as a component of your mortgage payment.

The amount of the premium is weighted by the amount of equity (the percentage of down payment), the loan amount, the borrower’s credit score, borrower’s income, type of loan (fixed or adjustable) and the property location.

There is another way to pay your mortgage insurance, called Lender Paid MI. The lender gives you a higher interest rate for your loan but this eliminates you needing to have separate mortgage insurance. The monthly out-of-pocket to you is approximately the same – your loan can be analyzed for which is less out-of-pocket each month.

To remove Mortgage Insurance, you must have at least 20 percent equity in your home. You may ask the lender to cancel MI when you have paid down the mortgage balance to 80 percent of the home’s appraised value.

However, if you have chosen Lender Paid Mortgage there is nothing to remove. Your rate just remains the same unless you refinance.

FHA Loans

The Federal Housing Association (FHA) also ensures the mortgage for the lender in case the borrower defaults. All FHA loans require the borrower to pay two mortgage insurance premiums:

The first premium is Upfront Mortgage Insurance which is currently 1.75 percent of the loan amount. For example, if your loan amount is $400,000 will have an Upfront premium of $7,000. You can pay this with your other lender fees or roll it into the loan amount, making the new loan amount $407,000.

You’ll pay the second type of MI premium monthly and is based solely on the amount of down payment and size of the loan.

Mortgage Insurance doesn’t fall off automatically. When your home’s value rises, you can refinance to get out of that monthly MI premium. There is no penalty to pay off your FHA loan to get rid of your Mortgage Insurance.

Leave a Reply